HOT PRODUCTS LIST

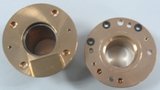

Spindle H916C

Spindle H920A/B

Spindle D1686

Spindle D1722

Spindle D1769

Spindle SC3163/3263/TL60

Spindle ABWR80

Spindle H912B

Spindle SC63

Spindle D1331

Excellon ...

Hitachi ...

Bearings ...

Collets ...

More Products List...

CONTACT US

SJ Techologies Ltd

Dujiangyan industry zone

Chengdu City,

Sichuan Province,

P.R.China

Zip:611830

Tel: 86-28-87111112;

86-18010641478

Fax: 86-28-87111112

sales@pcbchn.com

Copyright © 2003-2020 ·

SJ Tech, LTD